Jordan Wirfs-Brock / Inside Energy

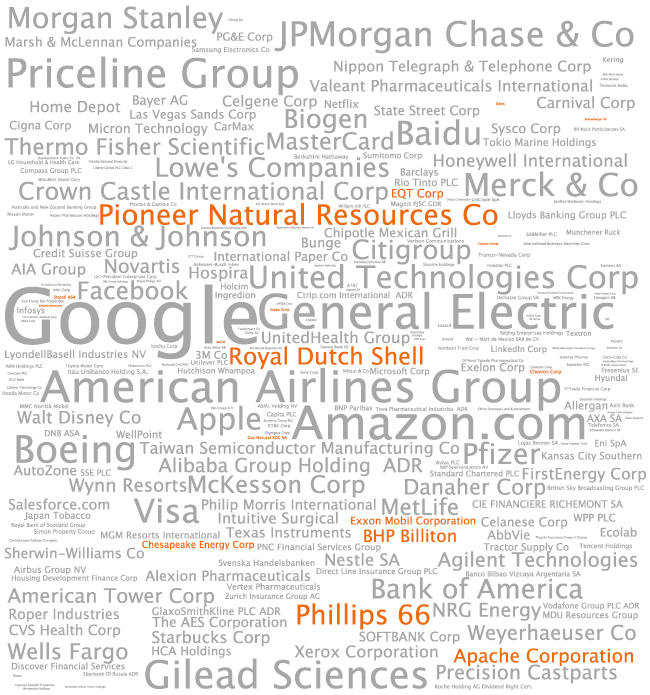

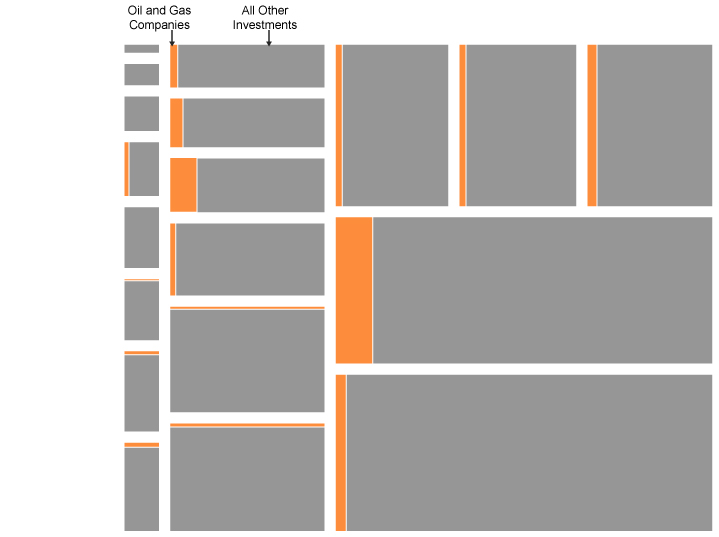

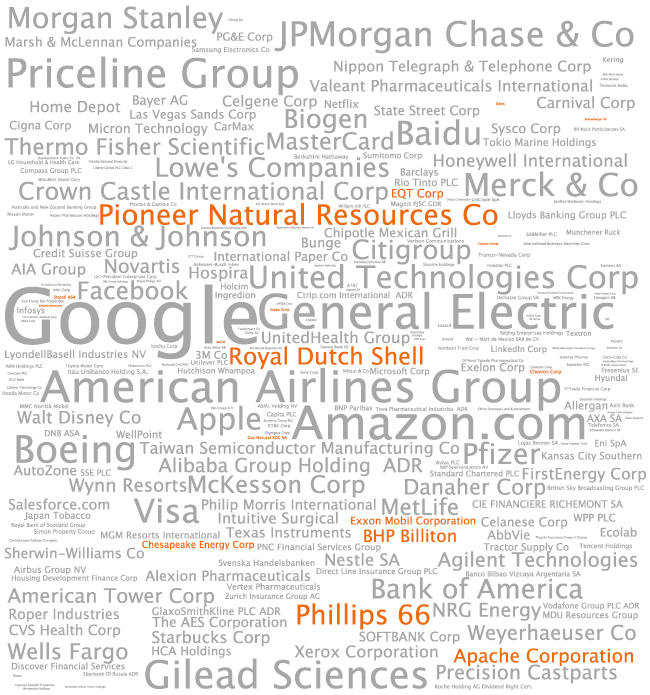

Here are the companies in a sample T. Rowe Price retirement account that represent more than 0.05% of the account\’s investments. The size each word is proportional to how much of the account\’s money is invested in that company. Oil and gas companies (not including utilities) are highlighted in orange.

(This is the first in an occasional series on the financing behind the country’s energy boom.)

Oil prices are slipping to levels not seen in years. That is bad for oil companies, but it has to be good for consumers, right?

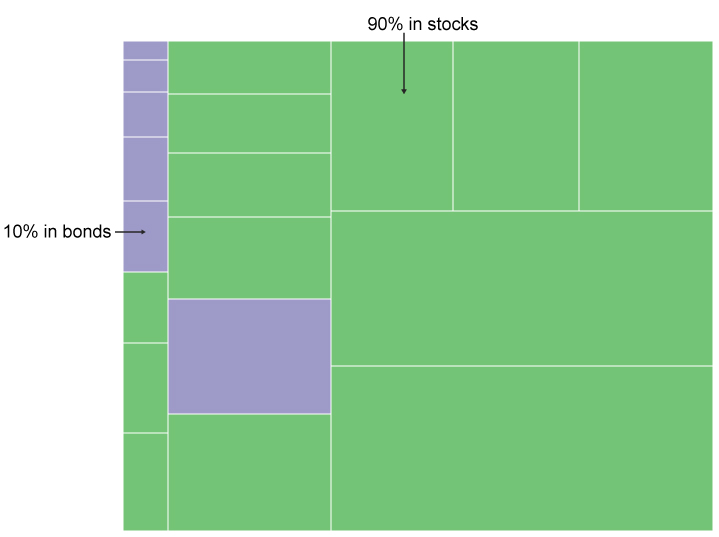

The story is more complicated than that. Nearly all of us with retirement accounts–the tens of millions of Americans with IRAs, 401Ks, 403Bs, or pension funds–are actually solidly invested in oil and gas companies.

At Inside Energy we decided to find out just how much of a stake one person — reporter Dan Boyce — personally has in oil and gas through his retirement fund–a Roth IRA from T. Rowe Price.

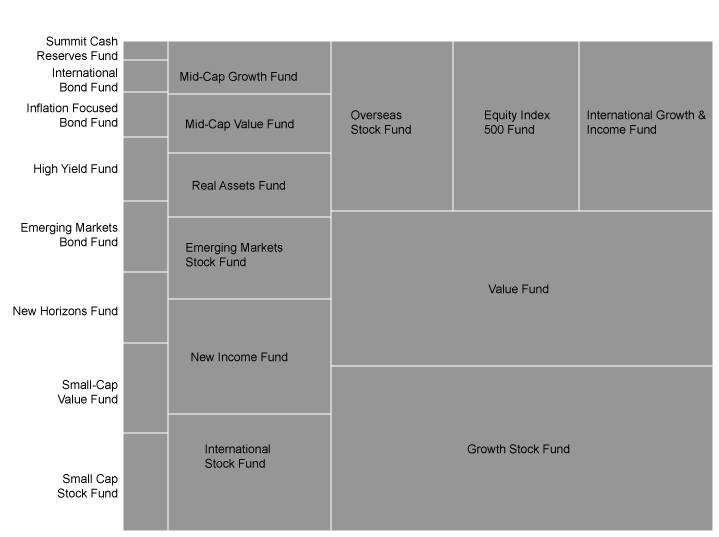

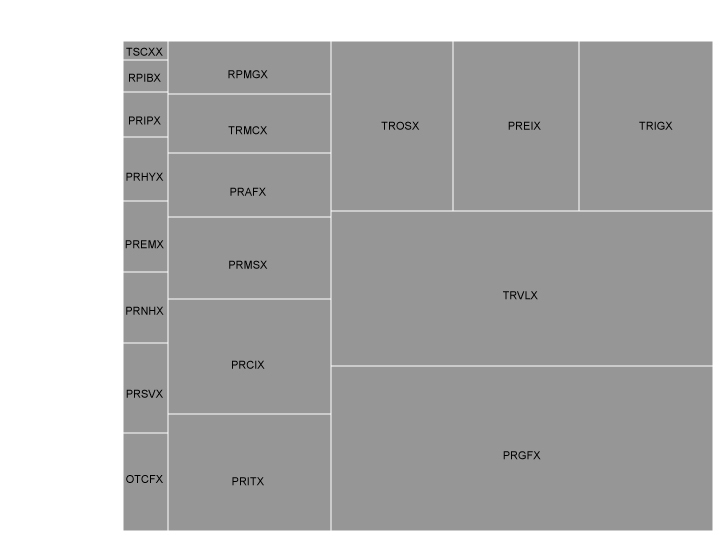

Click through this slideshow to see how it breaks down:

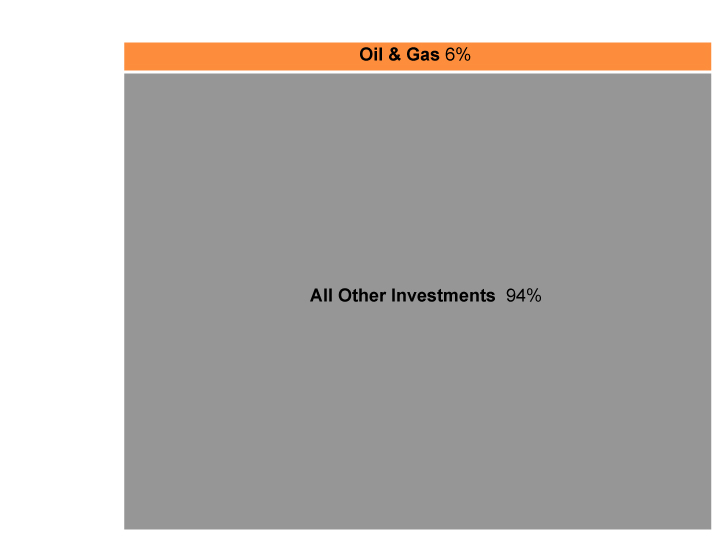

Scott Middleton, who works with investment consulting company Innovest, explained that most retirement accounts have a similar percentage invested in the energy sector – between five and 10 percent. Interestingly, “the energy sector” in Wall Street-speak basically means just oil and gas. Overall, oil and gas makes up about nine percent of the total stock market; other energy sources are a much smaller fraction of the market.

In investigating Dan Boyce’s own portfolio, what we find is a little less than six percent of his IRA is in oil and gas, or about $243.

Middleton said as oil prices shrink, so too will his $243. Most importantly, however, Boyce is betting on his IRA for the long-term–so short term fluctuations in price shouldn’t really concern him. Over the long-term, Middleton and others explained, the energy sector has been considered a very safe investment, yielding about a 10-percent annual rate of return.

While declining oil prices might be bad for one part of your portfolio, they’re good for other parts.

“Especially the chemical producers, their costs are lower, so they tend to do well,” Middleton said, adding transportation companies also benefit.

Ultimately, oil and gas is not a critical part of Boyce’s retirement fund.

But make no mistake, our retirement funds are absolutely critical for oil and gas.

The American Petroleum Institute says about 70 percent of US oil company worth is owned by tens of millions of US households, through our IRAs, our pensions, and our mutual funds.