The debate over tax reform has finally come to an end. Congress has passed its bill, and the President has signed it. But what’s it all mean for western energy?

Renewable Energy Threat Removed

Thousands of megawatts of new wind power are expected to be added to the western grid by 2020, partially due to an incentive called the production tax credit. The American Wind Energy Association says the PTC will help generate some $85 billion dollars in economic activity between now and 2020, when it is phased out. Colorado and Wyoming, among other western states, have both seen billions of dollars in new investment in wind projects thanks to the credits.

Both the House and Senate initially threatened the value of the PTC in the first versions of their tax reform bills. That was changed in the final version.

Greg Wetstone, CEO and President of the American Council on Renewable Energy said, “The conferees really saved us from the direct assaults. All of the house provisions that would have undermined renewable energy credits were rejected. Those provisions would have had a devastating and immediate impact on the sector.”

Still, the final tax package did leave in place a problematic provision for the wind industry: the BEAT provision. The Base Erosion Anti-Abuse Tax provision is intended to stop multinational companies from sidestepping tax liability overseas. That had the unfortunate side effect of also impacting renewable tax credits. A report from a Bloomberg analytics firm estimated $12-billion of annual renewable investment was at stake.

It’s a problem because renewable tax credits are typically sold off to investors as a way raise funds for new developments, which are very capital intensive up front.

“Remember… this is big capital investment. It’s like building a power plant and buying 25 years of fuel all at once,” Wetstone said.

Wetstone said, in the original senate bill the credits would have been taxed at an 100-percent rate, but in the final version, wind and solar companies can offset that tax by 80-percent. While it’s a big improvement, to Wetstone, it’s still not enough.

“Raising capital to build these projects is going to be a little harder, a little more expensive and maybe a little more than a little. That’s what we don’t know,” he said.

The BEAT provision will be taken into account following December 31, 2017.

Oil and Gas Winners

Kathleen Sgamma, president of the Western Energy Alliance, said the reduction in the corporate tax from 35-percent to 21-percent is a great boost to fossil fuel industries in the west.

“When you reduce tax rates, industries can create more jobs, create more economic activity, because instead of paying more in taxes, they have more capital that they can invest and create jobs and economic growth,” she said.

A Bloomberg report says the oil and gas industry is the biggest winner given it has the second highest tax rate of any sector — at 37-percent. The corporate tax reduction will open up billions to the industry, including $1 billion in profits to oil and gas firms. Chevron’s former CEO said in March the company would likely reinvest the extra cash or increase dividends to shareholders.

In the west, however, energy development is largely comprised of small and independent companies. They’ll see benefits in a simplified tax code.

“It’s about a fair, straight, across the board rate for all industries, treating all small businesses the same,” Sgamma said.

Coal

Coal companies were happy to see the alternative minimum tax cut in the final package. The AMT could have limited deductions and tax credits taken by companies.

Large coal companies like Arch and Peabody Energy, both of which operate in the western U.S., are just emerging from bankruptcies. The companies are still offsetting their profits against years of losses and won’t be positively impacted by the corporate tax reduction. In fact, the companies will be paying back losses for a longer time according to Daniel Scott, an analyst at MKM Partners.

Federal Mineral Royalties

Wyoming Legislative Service Office

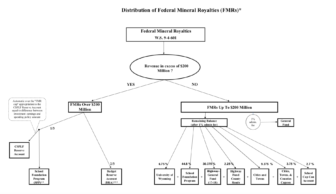

Distribution of Federal Mineral Royalties (FMRs) in Wyoming’s 2017 Budget Fiscal Databook

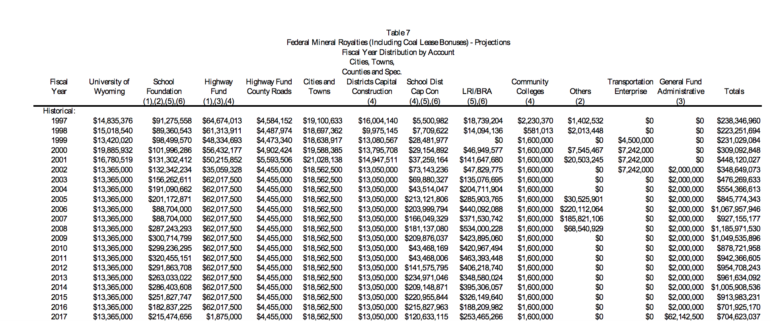

The tax reform package could pose a major threat to some western state budgets. A critical source of revenue in Wyoming, for instance, are federal mineral royalties which help fund education, infrastructure, and the state’s general fund. In 2017, Wyoming’s royalties plus coal leasing bonuses added up to $704 million.

Thanks to a piece of legislation called PAYGO, or the pay as you go act — tax cuts or other increases in spending must be balanced out by other reductions. Matt Lee Ashley is a Senior Fellow with the policy institute Center for American Progress.

Consensus Revenue Estimating Group

Federal Mineral Royalties (Including Coal Lease Bonuses) – Projections in the Wyoming State Government Revenue Forecast

“Because the cost of this tax bill is so high they can’t just skim off the top of a few programs,” he said. “It requires the automatic elimination of a number of programs including mineral leasing payments to make the math add up.”

But a spokesperson for Wyoming Senator Mike Enzi’s office said the Senator will “really work to make sure Wyoming would be protected,” adding, since 2010, Congress has waived those automatic budget cuts 16 times.

WHAT’S NEXT?

- Learn more about the history and future of clean coal in Madelyn Beck’s podcast special

- Having trouble understanding fracking? Check out these three animations

- If the US is taking a backseat in climate change policy, are cities leading the way? Dan Boyce unpacks that question here