WildEarth Guardians via Flickr Creative Commons

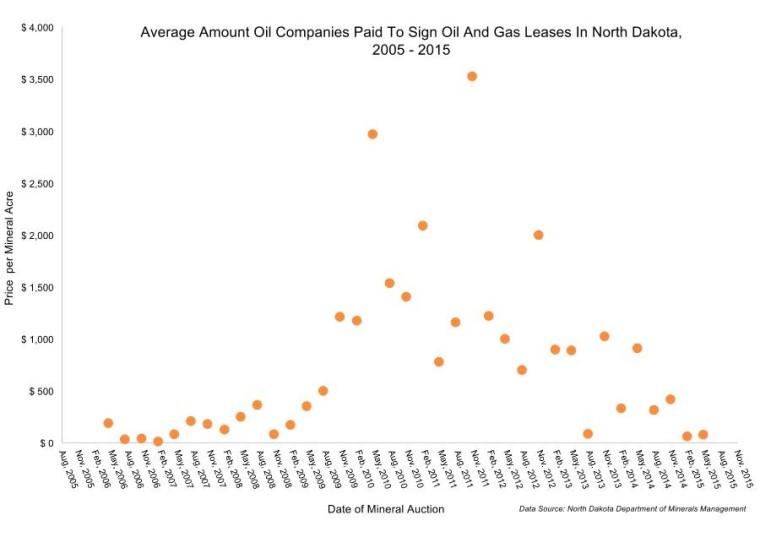

Before drilling on state or federal lands, oil companies must win the right to drill at a mineral auction. A recent state mineral auction in North Dakota and federal auction in Wyoming brought in the lowest amount of money in years.

At the height of the U.S. oil boom, less than a year ago, it wasn’t uncommon for an oil company to spend more than $1,000 an acre to drill on state land in places like Colorado and Wyoming. Prices were even higher in North Dakota’s Bakken oilfield, sometimes reaching over $10,000 per acre.

But oil prices have fallen from over $100 a barrel last May to less than $60 today. You can witness the effect in two recent mineral auctions in North Dakota.

The most recent auction took place May 5 at the state capitol in Bismarck. The room was filled with about 40 men in solid-color polo shirts. They work as brokers for oil companies, bidding on their behalf. My guide for the day was Tom Gray, a landman from Texas who’s been working in the Bakken since 2009. He’s old enough to be my grandfather, and wore a blue sport coat with gold buttons that smelled faintly of mothballs. He was really excited about being on the radio, and took a bunch of selfies with me before getting down to business.

Landman Tom Gray takes a selfie with Inside Energy reporter Emily Guerin at the North Dakota mineral auction in May, 2015. Credit: Debbie Becher.

“Let me show you what we’re doing today,” he said, unfolding a map of the Bakken.

Gray had drawn lines with a pink highlighter around areas that were up for bid. Before oil companies can start drilling on state lands, they need to sign a lease with the state. And before that, they need to out-bid everyone else in this room for the right to drill. It’s called a bonus: a one-time, per-acre payment that’s like a big thank you to North Dakota for allowing drilling on state lands.

A mineral auction is like a game of sedentary ping pong. When a parcel of interest appears on the screen, the landmen catch the eye of the auctioneer by lifting their finger or flicking a pen, and the bid bounces back and forth across the room.

Gray was bidding on a few parcels in McKenzie County, the heart of the Bakken. When the parcel came up, he called his client on the phone and adjusted his Bluetooth. At $725 an acre, he raised his arm. But the bidding quickly rose well above $1000, more than Gray’s client wanted to pay. So he shook his head and backed out. The bonus ended up going for $1050 an acre.

When the auctioneer finally brought bidding to a close a few hours later, the state had taken in about $1.8 million in bonus payments — about eight times less than the auction in May of last year. With low oil prices, companies aren’t making as much on the oil they sell, so they have less money to spend on new leases and bonuses. And it’s not just North Dakota — Wyoming also recently had its most disappointing federal mineral auction since the Great Recession.

Get the data: CSV | XLS | Google Sheets | Source and notes: Github

Drew Combs, head of the North Dakota Minerals Management Division, said he was a little disappointed in the outcome. All the money from the bonuses, and from royalties the companies pay, goes into trust funds that support government and public education in North Dakota. Those royalty payments have taken a big hit as well— down over 50 percent since last June.

“We were posting record numbers for so long,” he said of the state mineral auctions, and then the price of oil collapsed. “It’s a hard pill to swallow.”

There’s another reason why May’s auction was so disappointing to Combs: most of the really great Bakken parcels have already been leased. What’s left, he said, is called “goat pasture,” or parcels on the margins of the Bakken that command lower bonuses.

When oil prices were over $100 a barrel, some companies were willing to take a chance on marginal parcels. But now that prices have fallen, they won’t. Gray pointed to some goat pasture on his map, “There’s oil up there, it’s just that unless we see much higher prices for oil, it’s not really worth it.”

But companies will still spend a ton of money on parcels in the sweet spot of the Bakken, something an online mineral auction in March made very clear. I was sitting next to Combs in the final minutes, as he obsessively hit refresh every 20 seconds or so. The parcel for auction was in McKenzie County, surrounded by high-producing oil wells. It had come down to a bidding war between two smaller oil companies, until, in the last seven seconds, the Oklahoma oil giant Continental Resources swooped in and won the auction with a bid of $14,200 per acre.

There was gasping in the room, as Combs exclaimed, “Continental! Slid in there and bought their well! Slick.”

Nothing at the May auction went for even close to that — the average bid was $76 dollars an acre.

For oil and gas analyst Stephen Trammel of IHS, the takeaway from these auctions is clear: Companies are still optimistic the price of oil will rebound, so they’re still willing to invest in good Bakken wells.

In the mean time, there’s some great deals on North Dakota goat pasture.

What’s Next:

- Explore the outcome of mineral auctions in North Dakota, Wyoming and Colorado.

- Learn more about how the federal government auctions off mineral leases.

- Energy states are increasingly holding their mineral auctions online (much to the disappointment of landmen). Follow along at EnergyNet.